GLOBAL

REAL ESTATE CONSULTING

since 2000

Investment – Asset management – Valuation

25 years of performance

145 residential

buildings

57 commercial

buildings

36 plots

of land

19 industrial

buildings

2 churches

1 stadium

6 individual housing

estate

SERVICES

Portfolio management

- Ongoing analysis for optimal results/implementation

- Just-in-time management and information control

- Capital structuring (financing)

- Arbitrage among various scenarios

Transactions

- One rule: Discretion !

- Investment, acquisition / sale (spot, forward sales, renting, options, /leasing/sale & leaseback, sale & buy back… )

- Analysis of commercial strategies

- Monitoring, supervision of procedures (organisation, follow-up, reporting, legal assessment)

Investment Consulting

- Financial valuation (DCF ©, IFRS, market, tax, collateral values, assessment of risks and opportunities)

- Why selling/purchasing?

- Price, value, opportunity, measurements…

Firms

- Renting, purchasing, selling: financial or regulatory arbitrage

- Search / selection / valuation and implementation

- Commercial properties at large:(re)lease, (re)negotiation, transfer or sub-letting

Our success

CLINIQUE LA PRAIRE (VD)

2022-2024

Sale of the real estate assets of the CLINIQUE LA PRAIRIE, located on the shores of Lake Geneva near Montreux, under an exclusive Seller side mandate.

Comprising seven buildings on a plot of more than 23,000m2 for hospital and hotel operations.

Terrassière (GE)

2023

Sale of a building in the centre of Geneva under an exclusive seller side mandate.

MVP H (FR)

2021-2022

Industrial site, land and asset restructuring, 2.5 HA and ~9,000 m2 (storage, production, administration, etc.) Mandate: “All in”. Strategic advice, arbitration, valuation and market testing, preparation of prospectus, short list of investors, 2 rounds of tenders, selection, assistance and/or drafting of contracts (deeds, lease, transfer of shares), sale.

Campus Biotech (GE)

2012-2017

Full development (teaching, search of neuro/biotech firms). 44’000 sqm. 80% of the goal achieved in 7 months. Associated strategic assignments: site marketing, refinancing via tenders, administrative negotiations.

* ex Serono Int./Merck GmbH

Bellerive Campus (GE)

2017-2021

Advice for acquisition, valuation, development, DPSR negotiation, sale.

Quai de l’Île 13

2013-2019

“All-in-tasks” mandate: acquisition, site clearance, piloting, renovation, re-letting and sale.

Rue de Lausanne (GE)

2014-2017

Building elevation : financial and test arbitrage, study, architecture competition, permit applications, negotiations with tenants, solving oppositions. The biggest building elevation in the canton. 4 residential buildings. 7’200 sqm on the lakeside. Delivered in 2019.

Les Portes d’Aubonne (VD)

2012-2015

Overall development assignment: land acquisition, authorisations, development , marketing, financing, sale (2016). Around 6’000 sqm.

Vieille-Ville Portfolio (GE)

2010-2020

Acquisition, renovation and sale: residential house, old stones, patrician complex, Old Town of Geneva.

Rive-Gauche Portofolio (GE)

2010-2020

Acquisition, renovation and sale: by the lake, on the quays, Geneva.

About us

François Micheli

Member of the board

Lorenzo Pedrazzini

Member of the board

Bertrand Cavaleri

Co-CEO

Raphaël Reginato

Co-CEO

PUBLICATIONS

Real estate indicators

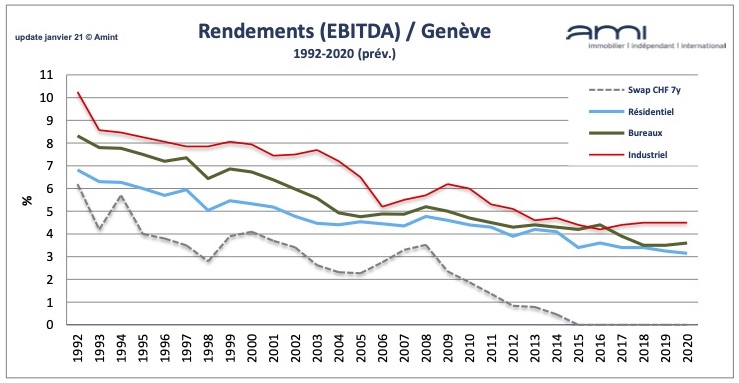

Discover all the office rent indicators (ILB, indicateurs de loyer de bureaux) since 2002, and the other publications and market analyses.

Press releases : selection

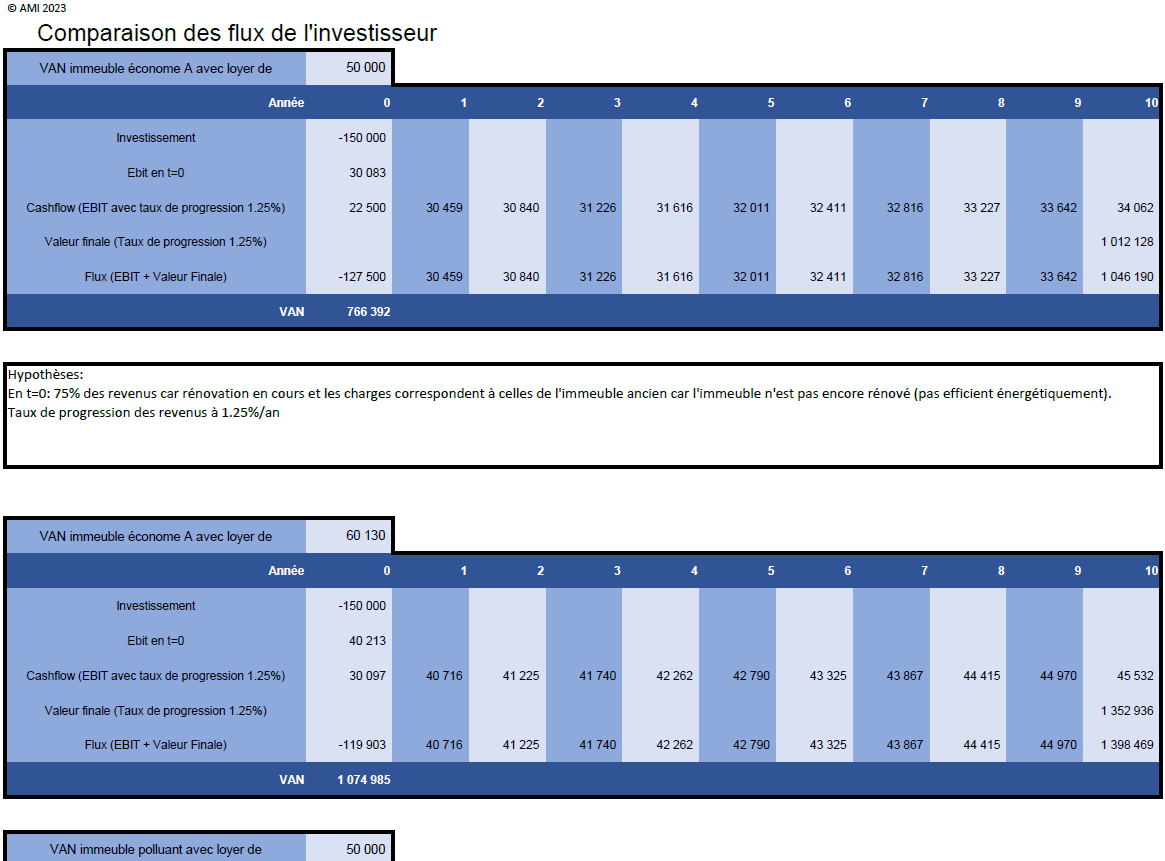

Le coût des passoires immobilières

Détail des calculs – article : Le coût des passoires immobilières

https://agefi.com/actualites/acteurs/le-cout-des-passoires-immobilieres

AMI – 09.06.2023

Le coût des passoires immobilières

« Le résultat est spectaculaire. D’abord, pour égaliser le rendement «d’avant», il faut augmenter les revenus de 20,26%. Cela peut se faire par des augmentations de loyers ou des subventions. Il faut que quelqu’un paie. »

AGEFI – 09.06.2023

Le prix des passoires immobilières

« Sauf que ce discours a un double effet, peu sentimental, lui: quelle est la décote d’un immeuble pas-soire (performance énergétique) par rapport à une norme vénale qu’il s’agit encore d’inventer? Un immeuble neuf vaut-il plus ou mieux qu’un immeuble d’il y a quarante ans ou plus, du fait que le droit administratif et la mode «éco +» sont aujourd’hui plus contraignants? »

AGEFI – 23.05.2023

References